Big Cuts to U.S. Cancer Research May Create Historic Opening for Biotech Investors

Issued on behalf of Oncolytics Biotech Inc.

VANCOUVER – Baystreet.ca News Commentary – The future of cancer research appears to be drifting away from the public sector to the private sector, with reports coming out that the current US administration could drastically reduce funding of the National Cancer Institute (NCI) by nearly 40%. Due to the rise in cancers among younger generations, tackling the issue is becoming more pressing than ever. New blood tests can detect cancer years earlier while we’re learning more about how cancers grow and spread. With less funding coming from the public sector, investors are watching several oncology innovators and healthcare providers as they continue to provide impressive developments, including from Oncolytics Biotech Inc. (NASDAQ: ONCY) (TSX: ONC), BeyondSpring Inc. (NASDAQ: BYSI), Cardiff Oncology, Inc. (NASDAQ: CRDF), Elevation Oncology, Inc. (NASDAQ: ELEV), and OS Therapies Incorporated (NYSE-American: OSTX).

The article continued: Statista projects a 20% rise in annual diagnoses by 2030, climbing to a 75% increase by 2050. Analysts at ResearchAndMarkets expect oncology spending to reach US$866.1 billion by 2034, growing at a 10.8% CAGR. Vision Research Reports puts the total even higher, forecasting the global oncology market to top US$903.81 billion in revenue over the same period with a 10.9% CAGR.

Oncolytics Biotech® Names New CEO to Accelerate Momentum in Immunotherapy Programs

Oncolytics Biotech Inc. (NASDAQ: ONCY) (TSX: ONC) a leading clinical-stage company specializing in immunotherapy for oncology, today announced the appointment of Jared Kelly as Chief Executive Officer and member of its Board of Directors.

Mr. Kelly is a successful biotech executive who has proven expertise in transformative deals and corporate strategy. Most recently, he played a central role in orchestrating the sale of Ambrx Biopharma to Johnson & Johnson for $2 billion. Prior to Ambrx, he advised multiple leading-edge biotech companies on M&A and licensing transactions at highly respected law firms, including Lowenstein Sandler LLP and Kirkland & Ellis LLP. He is a JD and LLM graduate of Georgetown Law.

“Mr. Kelly’s vision and track record is an extraordinary fit with the standout clinical data pelareorep has generated to date,” said Wayne Pisano, Chair of Oncolytics’ Board of Directors and outgoing Interim CEO. “We believe Mr. Kelly’s well-documented ability to prioritize clinical program development, execute successful financings, and attract the attention of large industry peers will help maximize Oncolytics’ potential to deliver transformative outcomes for patients and exceptional value for investors.”

Mr. Kelly added, “Pelareorep’s clinical data across multiple tumors is striking and represents the potential for a true backbone immunotherapy to address many in-need indications. Importantly, the data shows that pelareorep creates a robust immunologic response in difficult tumors and increases survival in a patient population where survival has historically evaded most patients. With a renewed focus and sharpened clinical development plan, we believe we will move pelareorep forward effectively and efficiently to a place where potential partners will see the value of a de-risked immunotherapy. I am excited to get to work accelerating development and unlocking significant value for stakeholders.”

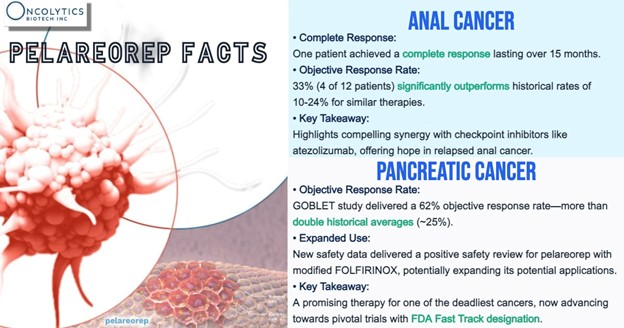

Pelareorep, an intravenously-administered immunotherapeutic agent has been granted FDA Fast Track designation by the U.S. Food and Drug Administration (FDA) in metastatic pancreatic ductal adenocarcinoma (mPDAC) and HR+/HER2- metastatic breast cancer (mBC). It has delivered compelling results in mPDAC, a high-value indication with significant unmet need. In Phase 1 and 2 trials involving more than 140 mPDAC patients, pelareorep has delivered a >60% objective response rate in tumor evaluable patients, which is more than double the benefit observed in historical control trials, and, separately, two-year survival rates 4-6 times those observed in control patients or in prior studies. In mBC, pelareorep recorded a meaningful survival benefit two randomized Phase 2 studies of over 100 combined mBC patients, IND-213 and BRACELET-1. Phase 2 objective response rate data in second-line or later unresectable squamous cell carcinoma of the anal canal (SCCA) patients continue to exceed historical data for treatment with a checkpoint inhibitor alone. These consistent efficacy signals, in combination with multiple chemotherapies and checkpoint inhibitors, uniquely position pelareorep as a high-potential asset for further development in-house and/or through strategic partnerships. Pelareorep also has a well-defined and favorable safety profile based on data from >1,100 patients across multiple tumor types.

To align incentives with long-term shareholder value, Kelly’s compensation package includes equity and milestone-based awards tied to future strategic transactions and financing objectives. The structure reflects Oncolytics’ intention to drive both clinical and corporate progress without overextending its cap table—while remaining attractive to potential collaborators.

CONTINUED… Read this and more news for Oncolytics Biotech at: https://usanewsgroup.com/2023/10/02/the-most-undervalued-oncolytics-company-on-the-nasdaq/

In other recent industry developments and happenings in the market include:

Clinical-stage biotech BeyondSpring Inc. (NASDAQ: BYSI) recently unveiled interim Phase 2 data at ASCO 2025 for its plinabulin-pembrolizumab-docetaxel combo in second-/third-line metastatic non-small cell lung cancer (NSCLC). The regimen delivered a 6.8-month median progression-free survival, 77.3% disease control, and a 78% 15-month overall survival rate, all markedly higher than historical docetaxel results.

"These promising Phase 2 results reinforce Plinabulin’s potential as a first-in-class therapy that addresses one of the most urgent challenges in oncology—acquired resistance to checkpoint inhibitors," said Dr. Lan Huang, PhD, Co-Founder, Chairman and CEO of BeyondSpring. "By restoring immune sensitivity and improving progression-free survival, disease control rate and overall survival, Plinabulin opens a new therapeutic path for the more than 60% of patients who stop responding to PD-1/L1 therapies."

Cardiff Oncology, Inc. (NASDAQ: CRDF) recently reported a 40% objective response rate in a Phase 1b trial of onvansertib combined with paclitaxel for metastatic triple-negative breast cancer (mTNBC). The response signal was observed exclusively at the highest dose of onvansertib, underscoring a potential dose-response relationship.

“We are highly encouraged by the robust efficacy signal and the tolerable safety profile observed with onvansertib plus paclitaxel in patients with mTNBC,” said Fairooz Kabbinavar, MD, FACP, Chief Medical Officer of Cardiff Oncology. “These findings offer clinical validation of previously reported preclinical data demonstrating synergy between onvansertib and paclitaxel.”

The combination was well tolerated, even in a heavily pretreated patient population, and aligns with preclinical data suggesting synergy between the two drugs.

Elevation Oncology, Inc. (NASDAQ: ELEV) has agreed to be acquired by Concentra Biosciences in a cash-and-contingent-value-rights deal valuing the company at $0.36 per share, plus potential future upside from asset monetization. The agreement includes contingent value rights tied to both the company's closing net cash above $26.4 million and the possible sale of its cancer asset EO-1022 within one-year post-closing.

Elevation had focused on developing precision therapies for solid tumors with high unmet need and emphasized the continued potential of EO-1022 as a differentiator in its appeal to buyers. The deal, unanimously approved by Elevation’s board, is expected to close in July 2025, pending shareholder and customary approvals.

OS Therapies Incorporated (NYSE-American: OSTX) is pursuing RMAT designation for OST-HER2, a listeria-based immunotherapy for recurrent, fully resected, lung-metastatic pediatric osteosarcoma. OST-HER2 has already received Rare Pediatric Disease, Orphan Drug, and Fast Track designations, positioning the company for a potential Priority Review Voucher if conditional approval is granted by September 2026.

A Type D FDA meeting is expected to finalize the statistical path forward, supporting the company’s goal of launching a rolling BLA submission later this year. In parallel, OS Therapies is preparing EMA PRIME applications and advancing additional immunotherapy and ADC candidates.

CONTACT:

Baystreet.ca

(250) 999-4849

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Baystreet.ca is a wholly-owned subsidiary of Baystreet.ca Media Corp. (“BAY”) BAY has been not been paid a fee for Oncolytics Biotech Inc. advertising and/or digital media, but the owner(s) of BAY also own Market IQ Media Group, Inc., which has been paid a fee from the company directly. There may be 3rd parties who may have shares Oncolytics Biotech Inc., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of BAY own shares of Oncolytics Biotech Inc. which were purchased in the open market. BAY and all of it’s respective employees, owners and affiliates reserve the right to buy and sell, and will buy and sell shares of Oncolytics Biotech Inc. at any time thereafter without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by BAY has been approved by the above mentioned company; this is a paid advertisement, and we own shares of the mentioned company that we will sell, and we also reserve the right to buy shares of the company in the open market, or through other investment vehicles. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.