Gold Climbs Above $3400. Here’s How Some Developers Are Leveraging the Moment

Issued on behalf of Lake Victoria Gold Ltd.

VANCOUVER – Baystreet.ca News Commentary – After hitting an extraordinary $3,400 per ounce level in April, and again this week, the price of gold is likely not done its climb. According to Bloomberg Intelligence’s Senior Commodity Strategist Mike McGlone, the current price gap between oil and gold points not only to a recession, but also to $4,000 gold. Taking it one step further, mining industry veteran Rob McEwen foresees investors flocking back to gold mining stocks, and a bull run to $5,000 gold. Amid this current gold environment, several mining players have been putting out updates recently, including Lake Victoria Gold (TSXV: LVG) (OTCQB: LVGLF), DRDGOLD Limited (NYSE: DRD), Maple Gold Mines Ltd. (TSXV: MGM) (OTCQB: MGMLF), Vista Gold Corp. (NYSE-American: VGZ) (TSX: VGZ), and Mineros S.A. (TSX: MSA).

Lake Victoria Gold (TSXV: LVG) (OTCQB: LVGLF), a junior gold developer focused on East Africa, continues to advance its near-term development strategy in Tanzania. A third-party commissioning auditor, Nesch Mintech Tanzania, has been formally retained and will participate in the commissioning process at Nyati Resources’ gold processing plant expected in June. This follows the signing of a non-binding Letter of Intent between LVG and Nyati for a potential small-scale development partnership. Nesch has been engaged to assess plant readiness, recovery rates, and potential optimization opportunities as Nyati prepares to bring a second processing unit online.

"Engaging Nesch Mintech at this stage ensures we bring third-party rigour and transparency to the commissioning process, which is fundamental to assessing the Nyati opportunity," said Marc Cernovitch, President and CEO of Lake Victoria Gold. "We are excited by the potential to leverage existing processing infrastructure and local ore sources to create a scalable gold production platform in Tanzania.”

Combined with the existing 120 tpd facility, the expansion is expected to deliver a total capacity of 620 tpd—laying the groundwork for a centralized gold processing hub under the proposed joint venture with LVG and MIPCCL.

“This audit is an important milestone as we advance this most compelling near-term gold development opportunity,” said Simon Benstead, Executive Director of Lake Victoria Gold. “By combining strategic processing infrastructure with high-potential development targets, the proposed joint venture has the potential to unlock meaningful value for all stakeholders. We look forward to working closely with Nesch Mintech to validate the plant’s performance and move confidently toward execution.”

Under the proposed partnership plan, mineralized material from LVG’s 100%-owned Mining Licences would be processed through Nyati’s 120 tpd facility and a second 500 tpd expansion plant currently being finalized—creating a centralized processing hub.

The audit by Nesch Mintech is a critical next step in validating that vision. The company notes that it is not underpinned by a current mineral resource estimate or Feasibility Study and remains subject to meaningful technical and economic risks. This collaboration offers LVG a chance to test key assumptions in the field and potentially self-fund continued exploration.

The Nyati LOI builds on LVG’s earlier disclosure that it was exploring small-scale development opportunities at its Tembo Project, within the company’s four Mining Licences.

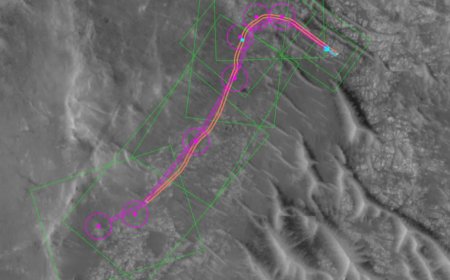

Located adjacent to Barrick’s Bulyanhulu Mine, Tembo has already seen more than US$28 million in historical exploration, including over 50,000 metres of drilling. Targets like Ngula 1, Nyakagwe Village, and Nyakagwe East remain open at depth and along strike—underscoring the project’s long-term discovery potential.

“Tembo has always stood out as a project with the potential to deliver both near-term value and long-term discovery upside,” said Benstead. “Evaluating this small-scale development opportunity allows us to test the system, generate operational insights, and potentially self-fund ongoing exploration. We believe this approach aligns well with our disciplined strategy and our commitment to responsible, phased development in Tanzania.”

While Tembo provides strategic upside, LVG’s Imwelo Project (acquired earlier this year) remains more advanced of the company’s asset portfolio. Fully permitted and supported by a 2021 pre-feasibility study, Imwelo is positioned for streamlined development near AngloGold Ashanti’s Geita Mine. The company continues to align capital and partnerships to advance toward construction.

To that end, LVG secured a non-binding gold prepay term sheet with Monetary Metals in late 2024. The arrangement provides upfront capital now, in exchange for delivering a portion of future gold production at a modest discount. This non-dilutive structure aligns repayment with LVG’s production timeline and outlines access to the value of up to 7,000 ounces of gold—helping fund construction and development at the Imwelo Project.

In February 2025, the company also completed a C$3.52 million investment tranche with Taifa Group at C$0.22 per share as part of a greater three-tranche C$11.52 million financing. Along with the deal, it brough in former Taifa CEO Richard Reynolds onto LVG’s board.

Further upside remains through a 2021 agreement with Barrick, which outlines up to US$45 million in milestone-based payments tied to success at Tembo.

With commissioning audits scheduled, a potential joint venture moving through due diligence, and potential funding agreements in place, Lake Victoria Gold continues to build momentum as one of East Africa’s most dynamic emerging gold developers.

CONTINUED… Read this and more news for Lake Victoria Gold at: https://usanewsgroup.com/2025/04/02/with-funding-commitments-in-place-a-gold-mine-is-being-built-and-this-stock-is-still-under-0-20/

In other industry developments and happenings in the market include:

DRDGOLD Limited (NYSE: DRD) grew revenue 4% last quarter thanks to stronger gold prices, despite a 12% drop in production caused by heavy rainfall. The company sold 1,109 kg of gold at an average price of R1,685,760/kg (~US$92,620), offsetting weather-related throughput and yield declines.

Cash rose to R950.5 million (~US$52.23 million) after paying a R258.7 million (~US$14.21 million) dividend, putting DRDGOLD in a strong position to consider a final dividend in August. While production may fall slightly below guidance, elevated gold prices continue to support the company’s outlook.

Maple Gold Mines Ltd. (TSXV: MGM) (OTCQB: MGMLF) just added 128 new claims to its Douay/Joutel property, increasing its total land position by 17% in Québec’s prolific Abitibi region. Surrounded by top-tier operators like Hecla and Agnico Eagle, Maple Gold is advancing toward a potential district-scale discovery.

"We are excited to have secured additional mining claims within the prospective yet largely untested structural-stratigraphic corridor that hosts Douay and similar nearby deposits," stated Kiran Patankar, President and CEO of Maple Gold. "Our regional staking program was guided by a new, robust 3D model integrating updated geological, geochemical, geophysical and structural data, which has already contributed to recent drilling success at Douay. This strategic land expansion north of Douay provides potential for sediment-hosted gold deposits along a major lithotectonic boundary and further enhances the Company's foothold along the favorable Casa Berardi-Douay Gold Trend."

The company is midway through a 12,000-meter winter drill program after standout results from the Nika Zone, where updated assays returned up to 5% higher gold grades. The newly staked area covers untested ground near the Casa Berardi Deformation Zone, a known host to major gold systems.

Vista Gold Corp. (NYSE-American: VGZ) (TSX: VGZ) reported Q1 2025 results with a $2.7 million net loss and a strong cash position of $15 million, maintaining zero debt. The company is advancing a revised feasibility study for its Mt Todd gold project in Australia, targeting higher early-grade production and slashing upfront capex by 60%.

"During the quarter, we made significant progress toward achieving our 2025 corporate goals,” said Frederick H. Earnest, President and CEO of Vista. “We remain focused on delivering the feasibility study by mid-2025, prioritizing the efficient use of our cash, and creating long-term value for shareholders through disciplined execution and strategic advancement of our Mt Todd gold project."

Mt Todd is fully permitted and strategically located in a Tier-1 mining jurisdiction, with prior drilling data informing the updated mine plan. Vista expects the study to act as a key catalyst in unlocking Mt Todd’s long-term value potential.

Mineros S.A. (TSX: MSA) recently obtained a critical Forest Harvesting Permit for its Porvenir Project within the North Caribbean Coast Autonomous Region (the RACCN) of Nicaragua, a region with a rich mining history, allowing construction of the underground mine to begin. This marks a major step toward operational readiness, though further environmental and plant operation permits are still required.

"Receiving the permit for construction of the Porvenir underground mine is a major step forward," said David Londoño, President and CEO of Mineros. "We appreciate the RACCN’s constructive review process and look forward to advancing the project in line with our responsible mining principles."

The company continues to engage closely with local communities and is advancing technical work, including updated pre-feasibility studies and final engineering.

Article Source: https://usanewsgroup.com/2025/04/02/with-funding-commitments-in-place-a-gold-mine-is-being-built-and-this-stock-is-still-under-0-20/

CONTACT:

Baystreet.ca

(250) 661-3391

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Baystreet.ca is owned by Baystreet.ca Media Corp. (“BAY”). BAY has been paid a fee for Lake Victoria Gold Ltd. advertising and digital media from a shareholder of the Company (333,333 unrestricted shares). There may be 3rd parties who may have shares of Lake Victoria Gold Ltd., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of “BAY” reserve the right to buy and sell, and will buy and sell shares of Lake Victoria Gold Ltd. at any time without any further notice commencing immediately and ongoing. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material, including this article, which is disseminated by BAY has been approved by Lake Victoria Gold Ltd. Technical information relating to Lake Victoria Gold Ltd. has been reviewed and approved by David Scott, Pr. Sci. Nat., a Qualified Person as defined by National Instrument 43-101. Mr. Scott is a registered member of the South African Council for Natural Scientific Professions (SACNASP) and is a Director of Lake Victoria Gold Ltd., and therefore is not independent of the Company; this is a paid advertisement, we currently own shares of Lake Victoria Gold Ltd. and will buy and sell shares of the company in the open market, or through private placements, and/or other investment vehicles. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.