Private-Sector Oncology May Be the Market’s Best-Understood Secret

Issued on behalf of Oncolytics Biotech Inc.

VANCOUVER – Baystreet.ca News Commentary – Cancer drug prices are rising sharply, with Bloomberg reporting growing concern over affordability and access. Meanwhile, Nova One Advisor projects the global oncology drug market will climb to US$366.24 billion by 2034, expanding at a 7.4% CAGR. As reports suggest the U.S. government may slash National Cancer Institute (NCI) funding by nearly 40%, the burden of innovation is increasingly shifting to the private sector. Recent updates from several biotech and diagnostics players—including Oncolytics Biotech Inc. (NASDAQ: ONCY) (TSX: ONC), Incyte Corporation (NASDAQ: INCY), Qiagen N.V. (NYSE: QGEN), BioNTech SE (NASDAQ: BNTX), and Bristol Myers Squibb (NYSE: BMY).

Long-term forecasts point to substantial expansion in the global oncology market. ResearchAndMarkets estimates the sector will reach US$866.1 billion by 2034, growing at a 10.8% CAGR. Vision Research Reports offers an even higher projection, anticipating the market will top US$903.81 billion by the same year, driven by accelerating demand for advanced diagnostics and treatments.

Oncolytics Biotech Inc. (NASDAQ: ONCY) (TSX: ONC) has entered a new phase of leadership with the appointment of Jared Kelly as Chief Executive Officer and member of the Board. Kelly brings a background in high-stakes biotech transactions and strategic immuno-oncology development, positioning him to guide the company through its next stage of clinical and business evolution.

Before joining Oncolytics, Kelly served as General Counsel at Ambrx Biopharma, where he played a key role in its $2 billion acquisition by Johnson & Johnson. His earlier work includes advising life sciences firms on licensing, partnerships, and M&A while at Kirkland & Ellis LLP and Lowenstein Sandler LLP. Now leading Oncolytics, he steps into a company advancing pelareorep, a virus-based immunotherapeutic designed to work synergistically with checkpoint inhibitors and other agents across a range of solid and blood cancers.

“Pelareorep’s clinical data across multiple tumors is striking and represents the potential for a true backbone immunotherapy to address many in-need indications. Importantly, the data show that pelareorep creates a robust immunologic response in difficult tumors and increases survival in a patient population where survival has historically evaded most patients,” said Jared Kelly, CEO of Oncolytics Biotech. “With a renewed focus and sharpened clinical development plan, we believe we will move pelareorep forward effectively and efficiently to a place where potential partners will see the value of a de-risked immunotherapy. I am excited to get to work accelerating development and unlocking significant value for stakeholders.”

Kelly’s appointment signals a clear strategic focus: advancing pelareorep toward key late-stage milestones through a capital-conscious approach that remains open to strategic collaboration.

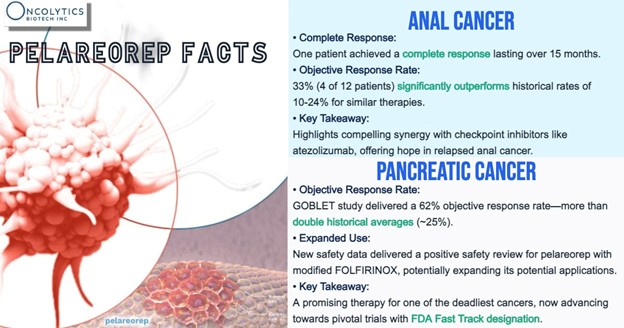

Pelareorep currently holds FDA Fast Track designation for both metastatic pancreatic ductal adenocarcinoma (mPDAC) and HR+/HER2- metastatic breast cancer (mBC)—a rare dual recognition that underscores its regulatory momentum. Across multiple studies, the virus-based therapy has demonstrated consistent immune activation, broad combinability with checkpoint inhibitors and chemotherapies, and encouraging response rates in challenging cancer types.

In mPDAC, pelareorep has achieved over 60% objective response rates in tumor-evaluable patients across Phase 1 and 2 trials—more than double what’s typically seen in historical benchmarks. Separate analyses also reported two-year survival rates four to six times higher than control arms or prior studies. In HR+/HER2- mBC, two randomized Phase 2 trials (IND-213 and BRACELET-1) showed survival benefits supportive of further investigation.

Meanwhile, a Phase 2 cohort in anal cancer pairing pelareorep with a checkpoint inhibitor reported partial or complete responses in nearly half of evaluable patients—substantially higher than historical norms for monotherapy in this setting.

“Mr. Kelly’s vision and track record is an extraordinary fit with the standout clinical data pelareorep has generated to date,” said Wayne Pisano, Chair of the Board and outgoing Interim CEO of Oncolytics. “We believe Mr. Kelly’s well-documented ability to prioritize clinical program development, execute successful financings, and attract the attention of large industry peers will help maximize Oncolytics’ potential to deliver transformative outcomes for patients and exceptional value for investors.”

Kelly’s compensation package includes equity grants and milestone-linked incentives tied to future financings and potential strategic transactions—aligning leadership priorities with long-term shareholder interests. The structure signals a commitment to advancing both clinical and corporate goals while preserving balance sheet discipline and maintaining appeal for potential partners.

With multiple cohorts progressing in the GOBLET study—including those in pancreatic and anal cancer supported by external funding and regulatory engagement—Oncolytics is positioned to move forward with a combination of scientific momentum, financial agility, and renewed strategic focus.

CONTINUED… Read this and more news for Oncolytics Biotech at: https://usanewsgroup.com/2023/10/02/the-most-undervalued-oncolytics-company-on-the-nasdaq/

In other recent industry developments and happenings in the market include:

Qiagen N.V. (NYSE: QGEN) and Incyte Corporation (NASDAQ: INCY) have partnered to co-develop a companion diagnostic for detecting CALR mutations in patients with myeloproliferative neoplasms (MPNs), a rare group of blood cancers.

"Together with Incyte we are building a multimodal companion diagnostic using a powerful technology like next-generation sequencing to facilitate highly accurate testing for several blood cancer genes at once," said Jonathan Arnold, Vice President and Head of Partnering for Precision Diagnostics at QIAGEN. "This new partnership strengthens our role in offering companion diagnostics for the growing number of biomarkers being discovered in onco-hematology and maximizing the clinical utility of the diagnostic for payor and patient benefit, thus supporting the work of innovative, science-driven companies like Incyte to improve patient outcomes."

The test will support the clinical development of Incyte’s targeted investigational drug, INCA33890, which inhibits mutant calreticulin—a protein mutation found in a significant subset of MPN patients. QIAGEN will develop the assay on its widely used Rotor-Gene Q MDx platform, with regulatory submissions planned alongside therapeutic development.

"The development of companion diagnostics for mutCALR, coupled with the potential for new medicines to selectively target disease-initiating cells, is a critical step toward changing the course of disease in patients with ET and MF," said Pablo J. Cagnoni, M.D., President and Head of Research and Development, Incyte. "As a partner, QIAGEN has the proven expertise in companion diagnostics development and approvals needed to support our ongoing work and commitment to transforming the treatment of patients with CALR-mutant MPNs."

This precision diagnostic is designed to identify patients most likely to benefit from treatment, streamlining clinical trial enrollment and ultimately aiding personalized care. The collaboration builds on both companies’ deep roots in oncology and signals a further push toward biomarker-driven innovation.

BioNTech SE (NASDAQ: BNTX), and Bristol Myers Squibb (NYSE: BMY) have entered a global strategic partnership to co-develop and co-commercialize BNT327, a next-generation bispecific antibody candidate for treating multiple solid tumors.

“Our collaboration with BMS, a pioneering leader in immuno-oncology, aims to accelerate and broadly expand BNT327’s development to fully realize its potential,” said Prof. Ugur Sahin, M.D., CEO and Co-Founder of BioNTech. “Our focus remains on advancing high-impact, pan-tumor programs and combination strategies in oncology, with BNT327 complementing our antibody-drug conjugate programs and mRNA-based immunotherapies.”

The collaboration combines BioNTech’s antibody engineering and immuno-oncology capabilities with BMS’s global oncology leadership. BNT327 targets both VEGF-A and PD-L1 to activate anti-tumor T-cell responses while reducing immunosuppressive signaling in the tumor microenvironment.

“Our deep experience and expertise in advancing and delivering groundbreaking immuno-oncology medicines positions BMS well to collaboratively realize the potential of BNT327, an asset with significant potential for transforming the standard of care for patients with solid tumors,” said Christopher Boerner, Ph.D., Board Chair and CEO of Bristol Myers Squibb. “We are impressed by the innovation that BioNTech has achieved to date, and we look forward to partnering to accelerate existing clinical trials and time to market, while expanding the number of potential indications.”

CONTACT:

Baystreet.ca

(250) 999-4849

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Baystreet.ca is a wholly-owned subsidiary of Baystreet.ca Media Corp. (“BAY”) BAY has been not been paid a fee for Oncolytics Biotech Inc. advertising and/or digital media, but the owner(s) of BAY also own Market IQ Media Group, Inc., which has been paid a fee from the company directly. There may be 3rd parties who may have shares Oncolytics Biotech Inc., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of BAY own shares of Oncolytics Biotech Inc. which were purchased in the open market. BAY and all of it’s respective employees, owners and affiliates reserve the right to buy and sell, and will buy and sell shares of Oncolytics Biotech Inc. at any time thereafter without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by BAY has been approved by the above mentioned company; this is a paid advertisement, and we own shares of the mentioned company that we will sell, and we also reserve the right to buy shares of the company in the open market, or through other investment vehicles. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.