A Historic Disconnect in Gold Markets Could Spell Big Opportunity

Issued on behalf of RUA GOLD Inc.

VANCOUVER – Baystreet.ca News Commentary – Goldman Sachs analysts say central banks are the main engine behind today’s record-setting gold rally, buying an estimated 80 metric tons of gold per month — worth about $8.5 billion at current prices. With macro uncertainty still dominating headlines, strategists like George Milling-Stanley of State Street Global Advisors believe gold’s appeal remains strong thanks to its defensive and wealth-preserving traits. And as bullion climbs, a growing number of analysts are calling for a breakout in gold mining equities. In this climate, several gold stocks are drawing fresh attention, including RUA GOLD Inc. (TSXV: RUA) (OTCQB: NZAUF), Bear Creek Mining Corporation (TSXV: BCM) (OTCQX: BCEKF), First Mining Gold Corp. (TSX: FF) (OTCQX: FFMGF), Hycroft Mining Holding Corporation (NASDAQ: HYMC), and Orla Mining Ltd. (NYSE: ORLA) (TSX: OLA).

Despite the run-up in gold prices, analysts at Jefferies say mining stocks are still lagging, noting a significant disconnect in valuations — with many still trading as if gold were stuck at $2,500 an ounce or lower.

RUA GOLD Inc. (TSXV: RUA) (OTCQB: NZAUF) is advancing a portfolio of high-grade, district-scale gold projects in New Zealand—an emerging exploration hotspot with deep historical roots and modern infrastructure. The company recently announced new high-grade intercepts from its Cumberland project, including 1 metre at 26.9 g/t gold and another at 16.2 g/t, building on a previously returned 62.2 g/t gold, including a standout prior result of 1 metre at 1,911 g/t gold. These hits confirm the near-surface continuity of the Gallant vein system, which became RUA’s first drill-tested target generated via VRIFY’s AI-powered targeting platform.

“From the very first drill holes, we intersected significant, wide quartz veins hosting high-grade gold, confirming historical intercepts,” said Robert Eckford, CEO of RUA GOLD. “This marks an exciting start, validating the effectiveness of the VRIFY AI targeting process and confirming near-surface mineralization with the potential to extend the envelope of known mineralization across a 2km structural zone.. It’s a major step forward for our hub-and-spoke strategy in Reefton… The Gallant prospect represents the first VRIFY AI target that we have drilled so far. This structure is traceable on surface for over 600m and remains largely untested along strike and at depth.”

Gallant sits just 3 km from the historic Globe Progress mine and features steeply dipping quartz veins up to 14 metres thick. Historic drill data from the area includes 20.7 metres of quartz with gold grades reaching 1,911 g/t near surface—highlighting the potential for a shallow, high-grade resource. RUA has now launched a follow-up program stepping 100 metres to the south, with assays pending.

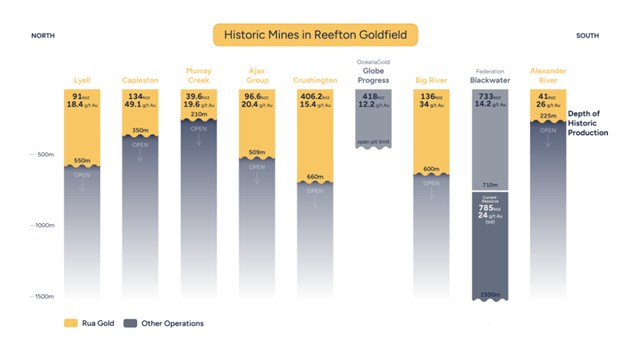

Beyond Gallant, RUA GOLD holds commanding control of the Reefton Goldfield, covering roughly 95% of a district that historically produced more than 2 million ounces of gold at grades between 9 and 50 g/t. The Auld Creek project continues to deliver encouraging results as well, with recent intercepts of 9.0 metres at 5.9 g/t gold equivalent and 1.25 metres at 48.3 g/t. Notably, only two of the four known mineralized shoots are currently included in the working model. Previous drilling has returned 12 metres at 12.2 g/t gold equivalent, including a 2-metre stretch at 54.8 g/t.

Auld Creek also hosts significant antimony mineralization—an increasingly strategic metal trading above US$50,000 per tonne. Surface samples have shown grades above 40% antimony, and drill holes have returned multiple intercepts over 8%. The New Zealand government’s early 2025 declaration of antimony as a critical mineral further elevates the project’s dual-metal value proposition.

On the North Island, RUA GOLD is progressing its Glamorgan project in the Hauraki Goldfield, where a second surface campaign outlined three distinct gold-arsenic anomalies across a 4-kilometre corridor. Rock chip sampling returned up to 43 g/t gold, and CSAMT geophysical surveys identified resistive zones typical of quartz-rich vein systems. Drill access is in the final stages of approval, with targets prioritized through VRIFY’s DORA AI engine.

Backed by $5.75 million in capital and led by a leadership team with over $11 billion in past mining exits, RUA GOLD is aiming to uncover high-grade discoveries in underexplored terrain. With multiple active programs, AI-guided targeting, and a pipeline of assays and agreements on the horizon, the company is positioning itself as one of New Zealand’s most advanced early-stage gold explorers heading into 2025.

CONTINUED… Read this and more news for RUA GOLD at: https://usanewsgroup.com/2025/04/02/others-found-1911-g-t-here-before-now-a-proven-11b-mining-team-is-back-to-finish-the-job/

In other industry developments and happenings in the market include:

Bear Creek Mining Corporation (TSXV: BCM) (OTCQX: BCEKF) reported Q1 2025 production of 8,262 ounces of gold and 36,466 ounces of silver from its Mercedes Mine, with results impacted by contractor issues at the Marianas and Rey de Oro zones.

“Q1 2025 was focused on managing the transition to narrow vein mining at Mercedes, completing the Technical Report... and launching the Strategic Review,” said Eric Caba, President and CEO of Bear Creek Mining. “We expect the transition at Mercedes to continue through the second quarter of 2025 as we work to resolve contractor issues and bring Marianas production in line with expectations.”

The company posted a $13.3 million net loss on $23.7 million in revenue, with AISC reaching $2,646 per ounce. A strategic review is underway, and $10 million was raised through a private placement to support operations. Bear Creek also amended its debt with Sandstorm and Equinox, deferring interest payments and securing an additional $6.5 million in working capital credit.

First Mining Gold Corp. (TSX: FF) (OTCQX: FFMGF) continues to strengthen its Duparquet Gold Project with multiple new intercepts from both the Miroir and Valentre zones, including 2.77 g/t gold over 11.1 metres and 3.96 g/t over 9.3 metres, respectively. Miroir remains open for expansion, while Valentre drilling confirmed deeper extensions of high-grade structures below 330 metres.

"The confirmation of the continuity of near-surface mineralization in the Valentre and Miroir areas demonstrates that this well-established resource... can continue to grow," said Dan Wilton, CEO of First Mining Gold. "Duparquet is emerging as one of the largest gold development projects in Quebec and we are continuing to advance it through the development process."

Two rigs are active on site, with follow-up drilling planned through the fall. Duparquet currently hosts over 6 million ounces in combined M&I and Inferred resources and is one of the largest undeveloped gold projects in Quebec.

GoGold Resources Inc. (TSX: GGD) reported strong Q2 2025 financials driven by its Parral operations, with revenue of $17.6 million and 555,511 silver equivalent ounces sold at an average price of $31.70. The project generated $5.1 million in cash flow, contributing to a $2 million increase in the company's cash position, now totaling around $135 million after a recent bought-deal financing.

“Parral continued to generate significant cash flow for the Company during the quarter, providing operating cash flow of $5 million… and increased our cash balance by $2 million at quarter end,” said Brad Langille, President and CEO of GoGold Resources. “This gives us an approximately $135 million cash balance today putting us in a very strong financial position to execute on Los Ricos South.”

AISC for the quarter was $22.98 per ounce, down from the prior year, and net income reached $3.36 million. This performance supports ongoing development at the Los Ricos South project.

Orla Mining Ltd. (NYSE: ORLA) (TSX: OLA) released its inaugural underground mineral resource estimate for Camino Rojo, identifying 50.1 million tonnes grading 2.58 g/t AuEq for 4.16 million gold-equivalent ounces in the Measured and Indicated category, and an additional 5.6 million tonnes grading 2.33 g/t AuEq for 0.42 million ounces Inferred.

“This initial underground resource marks an important milestone at Camino Rojo,” said Jason Simpson, President and CEO of Orla Mining Ltd. “This resource crystallizes our belief in the potential for a future underground operation.”

The resource incorporates sulphide mineralization and the down-plunge Zone 22 extension, which accounts for only a portion of the estimate and remains open at depth. Recovery assumptions are supported by metallurgical testing and tailored to three processing options, including CIL and POX. Orla will now move toward a Preliminary Economic Assessment and exploration drift design to de-risk future construction decisions.

Article Source: https://usanewsgroup.com/2025/04/02/others-found-1911-g-t-here-before-now-a-proven-11b-mining-team-is-back-to-finish-the-job/

CONTACT:

Baystreet.ca

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Baystreet.ca is owned by Baystreet.ca Media Corp. (“BAY”). BAY has been paid a fee for RUA GOLD Inc. advertising and digital media from the company directly (forty-five thousand dollars Canadian for a three month contract subject to the terms and conditions of the agreement from the company direct). There may be 3rd parties who may have shares of RUA GOLD Inc., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of “BAY” DOES NOT own any shares of RUA GOLD Inc. at this time, but reserves the right to buy and sell, and will buy and sell shares of RUA GOLD Inc. at any time without any further notice commencing immediately and ongoing. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material, including this article, which is disseminated by BAY has been approved by RUA GOLD Inc. Technical information relating to RUA GOLD Inc. has been reviewed and approved by Simon Henderson, CP, AUSIMM, a Qualified Person as defined by National Instrument 43-101. Mr. Henderson is Chief Operational Officer of RUA GOLD Inc., and therefore is not independent of the Company; this is a paid advertisement, we currently own shares of RUA GOLD Inc. and will buy and sell shares of the company in the open market, or through private placements, and/or other investment vehicles. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.